Transformation of a company by Efficient Resource Flow Alignment ©

*This is a [zero-AI-text]* Grigory Miloradov, DEXENTRI Consulting (c) 2023

A brief outline for a plan of efficiency-focused transformation

Efficient Resource Flow Alignment © (ERFA management methodology) has been recently introduced by DEXENTRI Consulting with the aim to help companies to improve efficiency of their organization by focusing on transmission of flows of money and work inside and through the company.

Why companies need an efficiency-focused transformation?

Many management methods fail on the fundamental efficiency challenge, and accumulated inefficiencies are exposed by massive layoffs of hundreds and thousands of employees even by market leaders. Any “business organism”, like a living creature, manages itself with its own goals in mind, and those goals are very often not the ones set by the business owners and shareholders. An organization minimizes effort and maximizes consumption – this is the “law of corporate relaxation” that I discussed in one of my previous blogs of this series. Organizations tend to hide consumption of resources and production of value in their “jungles of internal process complexity”. No matter how efficient your company seems to perform, it is highly likely that it could be much more efficient. Potentials to increase efficiency are hidden. Efficiency problems for every business are caused by sub-optimal flows of money and work through the company as a system, in process of transforming value. This is the reason enough for an efficiency-focused transformation. With all due respect to ESG and digital transformation the “law of corporate relaxation” can ruthlessly undermine any digital, ecological, social or other agenda. While going digital, data driven, green or socially responsible, think about trimming your “business organism” to uncover hidden efficiency potentials. It is feasible and quite easy by focus on flows of money and work INSIDE THE ORGANIZATION.

Advantages of Efficient Resource Flow Alignment © (ERFA management methodology) for efficiency-focused transformation

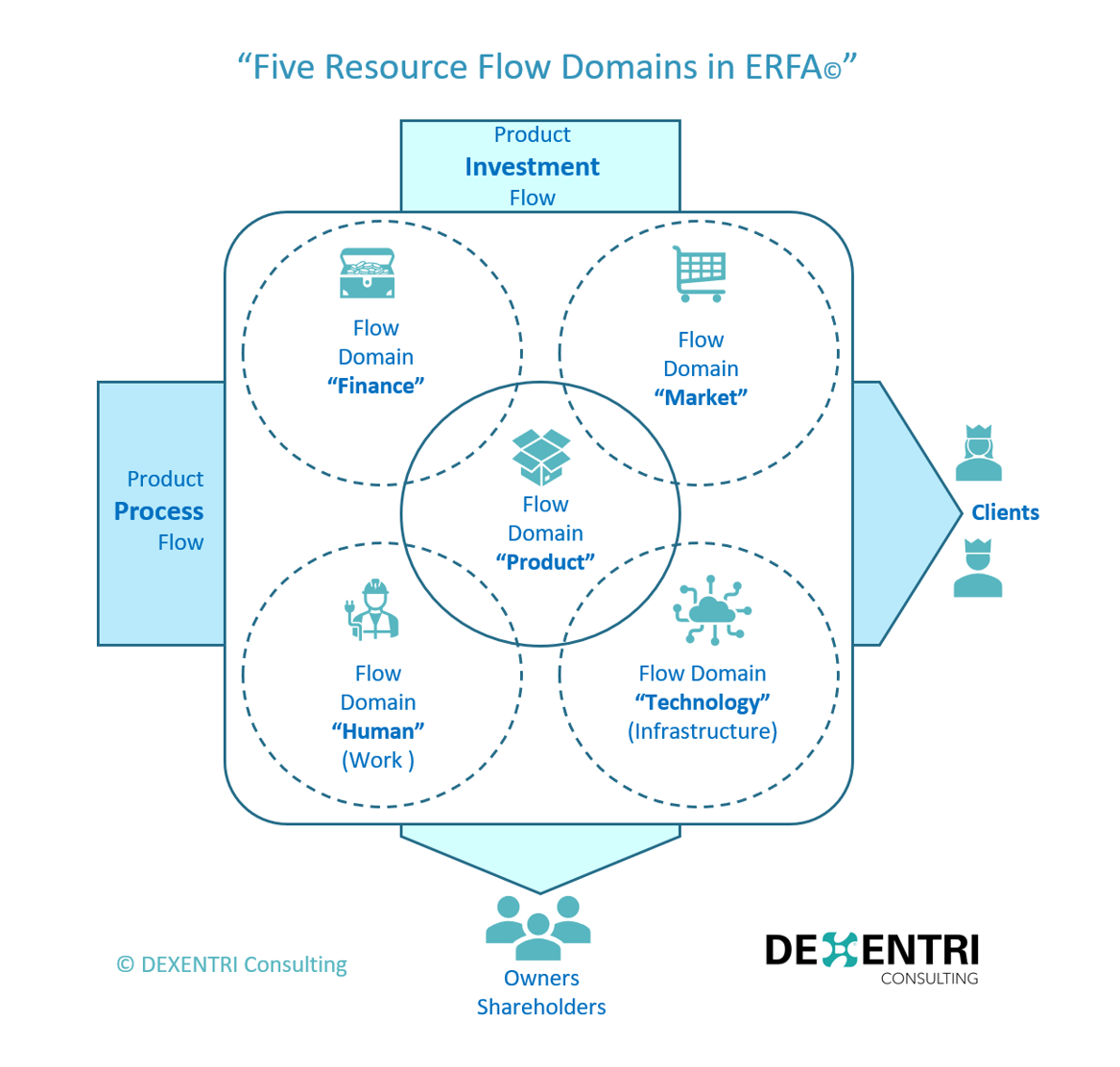

I wrote about the management methodology of Efficient Resource Flow Alignment © (ERFA) that is proposed, introduced, and practiced by DEXENTRI Consulting to help by optimizing the flows of money and work THROUGH ANY BUSINESS ORGANIZATION. Whereas there are many concepts aimed at response to disruption or at specific areas of efficiency in product and project management frameworks, © ERFA looks at a company as a “black box” with inputs and outputs with external world – a simplified total system view approach addressing the throughput and flows inside the system. This facilitates pragmatism, simplicity and consistent logic, and reduces ambiguity.

What is the plan for a © ERFA Transformation?

The good thing about ERFA © Methodology is that you can transform any business organization, in any industry, of any size, in any phase of its lifecycle – and do it all by your internal effort. Below is an outline of initial three moves.

Move one: Status-quo analysis of Product-as-Investment and Product-as-Process

Firstly, the transformation starts by analysis of status quo. With a Product-as-Investment analysis of every product and the total portfolio, you will know the weight of investment in each product in the total portfolio and understand on high-level how each product spends the investments that are allocated to it (in terms of technology, infrastructure, workforce, marketing spending and support functions’ work consumption). You will review the weights of products in invested money and in current and expected payoffs, adding the risk component of each investment. As a result, you will have a classical risk-and-return picture of diversified investment portfolio of your products. And you can also add a dynamics perspective to this picture with flashbacks on the same portfolio 1 and 2 years before, and with a desired picture 1 and 2 years ahead. By a Product-as-Process dimension view you will see each product as a combination of end-to-end business processes. Here, grouping the products by weight and dynamics, you will get into deeper detail of specific cost components for each end-to-end product’s process of value delivery to your clients.

Move Two: Key decisions and their execution

Secondly, you make decisions introducing © ERFA methodology of managing your business by 5 Flow Domains. You set up the ERFA management framework – the new rules of the game in your company.

You form the 5 internal Flow Domains that shall transmit money flow sequentially and getting work done in exchange for money. These Flow Domains are: “Finance” Flow Domain (F), “Market” Flow Domain (M), “Product” Domain (P), “Technology” Flow Domain (T), and “Human” Flow Domain (H). You announce the decision to start transformation journey and form 5 Flow Domains. It is important to communicate the reasons and goals of the transformation, its timing and expected results, reassuring your team that the transformation will be collaborative and respectful leading to tangible wins for all engaged, loyal and contributing employees. You present new virtual roles of 5 Heads of Flow Domains and draft Internal Frame Flow Agreements between Flow Domains. This crucial step presents the new “rules of the game” to your team, allowing them to associate themselves with the reshaped future. Simultaneously, you appoint all 5 virtual Heads of Flow Domains, announce soon-to-be-filled Head-of-Domain vacancies, and, on exceptional and temporary basis, enact combining two or even more Head-of-Domain roles by one person.

This is not an organizational structure change (yet) – you can keep the existing structure and just assign overlay 5 sets of authority and responsibility upon your current top employees. Virtual overlay roles can be compared to committee or taskforce building. You open 5 sub-accounts in your bank, one for each Flow Domain, and delegate authority for the accounts to Heads of Flow Domains to spend money upon verification by financial controller or accountant. Product Domain gets a sub-account that does not transact with external world, only with 4 other sub-accounts of Flow Domains. You prohibit any spending that bypasses the 5 sub-accounts. Heads of Flow Domains see they will have trust, responsibility, and authority of decisions. Money will have just 4 gateways of entry and exit to your Company. And each gateway will have just one gatekeeper. The eventual discrepancies and mismatches between your existing structure and the ERFA flow alignment domains will be evident, but they will gradually regulate themselves upon your common sense during the first two quarters since introduction of new rules of the game – the structure may be adjusted if needed. At start, it is the interworking of 5 heads of flow domains that matters, as there will be internal contracts of “money - delivery” between them, and they will find hard compromises in bargaining.

Move Three: operational infrastructure for © ERFA rules of the game

Thirdly, set up the operational infrastructure to support the new rules. Set up your ©ERFA cash flow sheets (Excel or Google Sheets will fit the purpose). You might already have an ERP, CRM, and other business support systems in place. You don’t need to replace them at once, just start reflecting the flows of sub-accounts of Flow Domains in a simple and regular way and take care of strictly preventing any form of spending money that bypasses the Flow Domains (and their real bank sub-accounts).

Move the first “virtual” investment into the company as Working Capital sum that Shareholder(s) have given to the Chief Executive Officer. This triggers the internal negotiating between Heads of Flow Domains. Each of them will now receive money and commit to their delivery in return. Perform the 1st round of goal setting and budgeting in the new ERFA rules of the game.

Start performing Product-as-Investment and Product-as-Process analysis with newly installed Heads of Flow Domains – do a test run of review right at the start for as if you have been working in © ERFA already in the previous quarter. This will be a useful exercise and may reveal necessities to optimize your Product Portfolio by eliminating some products, initiating inclusion of new products, or modifying the existing products.

With all the above completed, you will have transformed your company, enabled optimal alignment of flows of money and work, and removed any chance for your “business organism” to hide its over-consumption of resources and under-production of value in the “jungle of internal process complexity”.

What results to expect and when?

Transformation is not a one-time event, you will further iterate in the © ERFA methodology, learning lessons from every quarter and unleashing potentials to improve performance. It will be a challenging and sometimes delicate path, requiring diplomacy, empathy, and human touch.

You will see substantial improvements in your efficiency after 2 or 3 quarterly reviews in © ERFA. The simple fact of now having just 4 points of entry and exit of money into the company, with just one person accountable for each of the points (sub-accounts) will lead to reduction of unnecessary, unjustifiable, or ownerless spending. This gives immediate positive effect on the bottom line. Later, the effects will manifest in improving margins of every product, boosting, and cleaning up product portfolio, stimulating sales by better bonus perspectives and reducing cost of corporate functions operations by cutting off work that no product wants to consume.

Why it is a good idea to get help of specialists to transform by © ERFA

You can transform your company just all by your internal effort. As you can imagine from the above, the transformation will touch vital interests, authority bastions, career trajectories, perceptions, and informal culture. There are also intersections of © ERFA with other frameworks like Agile, Scrum, Kanban, or SAFe, and with organizational management concepts like “zone to win”.

There will be complexities for holding structures and early startups, and regulatory specifics by country for internationally operating businesses. With many of such aspects it is advisable to get support of © ERFA consultants to get results faster and with less turbulence. But a self-starter can go for it all alone and succeed. Support of external consultants will substantially smoothen the transformation and help to maintain good working climate in the waviest period. I recommend that you start anyway and get support and boost by DEXENTRI Consulting that developed © ERFA, has expertise and ability to answer any question or challenge you might face, and is fully committed to vivid success of your transformation journey.

Be sure that you can always count on DEXENTRI Consulting to implement and develop your © ERFA management system. We are there to help: www.dexentri.com

Having set the foundations of efficiency-focused transformation, you will need to dive deeper into your Product Management practice and align your product management frameworks with © ERFA. This will soon be topic of a separate article.